How to Calculate Rental Property ROI: A Foolproof Guide for Smart Investors

A good rental property ROI typically ranges between 8% and 12%. Any return above 15% stands out as excellent.

Smart investment decisions depend on your ability to calculate rental property ROI. This skill is a vital part of real estate investing, whether you’re experienced or just starting out. Vacation rental experts actually suggest aiming for nothing less than 30% cash-on-cash return. The industry’s average sits around 8%.

To cite an instance, see these numbers: A vacation rental needs $445,000 in total investment. It generates $90,000 in gross income with $40,000 in operating costs. The net income comes to $50,000, which gives you an 11.24% ROI. These figures hit the sweet spot for profitable investments perfectly.

Returns vary significantly in quality. This piece walks you through the ROI calculation process step-by-step. You’ll learn what makes a good return for different property types and discover practical ways to boost your investment’s performance. The knowledge you gain will help you analyze properties confidently and fine-tune your existing portfolio for better returns.

What is ROI and Why It Matters for Rental Properties

ROI stands as the key metric to review rental property profitability. ROI shows how well an investment performs compared to its cost. Property investors get vital information about whether a property belongs in their portfolio through this calculation.

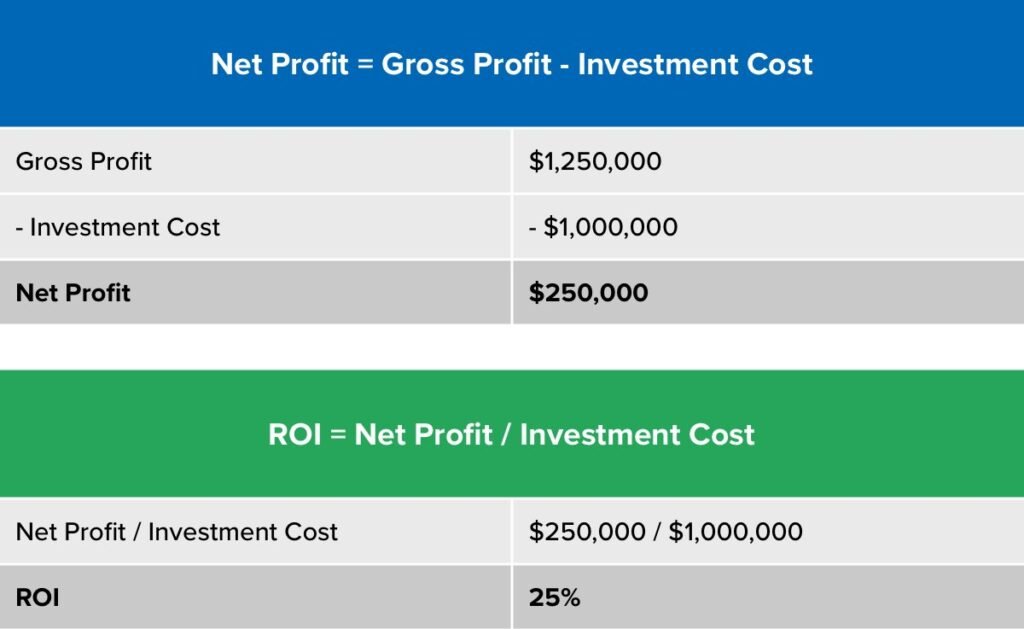

The simple ROI formula works like this:

ROI = (Net Return on Investment ÷ Cost of Investment) × 100

This percentage shows your rental property’s profit versus your investment. To cite an instance, a $100,000 property investment that brings in $9,000 yearly after expenses gives you a 9% ROI. You can use this clear measure to compare your property’s performance against other investments.

Your rental property’s ROI helps you do more than just track profits. You can review different properties based on expected profits. The calculation tells you if a potential investment hits your minimum needed return (hurdle rate). You can also spot ways to cut costs or boost revenue to improve performance.

Rental properties need more detailed ROI calculations than other investments because they must factor in:

- Debt and interest rates

- Property taxes and insurance

- Ongoing maintenance costs

- Original equity investment

- Regular rental income

Most investors look for a 5-10% ROI on rental properties, though market conditions affect what makes a “good” return. Riskier markets need higher returns to balance the uncertainty. Some vacation rental experts suggest going for even better returns—12% or more—based on your strategy and risk comfort level.

ROI gives you a standard way to match up investment opportunities. Instead of just looking at dollar figures, ROI lets you compare properties of different values fairly, whatever the price point.

ROI helps you make smart choices throughout your ownership. The focus changes from just upfront costs to the whole financial picture. You can decide whether to keep, sell, or refinance properties based on real numbers rather than gut feelings.

Risk management becomes easier with ROI. You can spot potential money-losing properties before buying. On top of that, keeping track of ROI while you own the property helps you quickly find underperforming assets and fix issues.

Rental property investors should know about ROI variations, like cash-on-cash return. This specifically measures the return on actual cash invested instead of total property value. This matters most when using financing, as properties with mortgages might show modest cash flow but better overall ROI thanks to paying down the mortgage and property value increases.

ROI works as your financial guide—helping you make investment choices, track performance, and ensure your real estate plans line up with your wealth-building goals. Without this measure, you’re investing in the dark, unable to tell if your properties truly help your financial success.

Step-by-Step: How to Calculate Rental Property ROI

Calculating rental property ROI might feel daunting at first. The process becomes simple when you break it down into manageable steps. Let’s explore how successful investors determine if a property will give them worthwhile returns.

1. Add up your total investment

Your complete investment amount forms the foundation of accurate ROI calculations. This goes beyond the property’s purchase price and includes all upfront costs:

- Purchase price: The final amount paid for the property

- Closing costs: These range from 2-5% of the purchase price

- Renovation costs: Any repairs or improvements needed before renting

A property purchased for $250,000, with closing costs of $10,000, and renovations of $15,000 brings your total investment to $275,000.

2. Estimate your annual net income

Your annual net profit calculation needs all operating expenses subtracted from rental income:

- Annual rental income: Monthly rent × 12 months

- Operating expenses: These include property taxes, insurance, maintenance (about 1% of property value yearly), property management fees (8-10% of monthly rent), and vacancy costs

Let’s say your monthly rent is $2,500 ($30,000 annually) and yearly expenses total $11,400. This gives you an annual net profit of $18,600.

3. Use the ROI formula

The simple ROI formula works like this:

ROI = (Annual Net Profit ÷ Total Investment) × 100

Our example shows: ROI = ($18,600 ÷ $275,000) × 100 = 6.76%

Your financing method changes the calculation. Cash purchases use net profit divided by total investment. Properties bought with loans often show higher ROI despite lower net income because they utilize debt. Here’s what this looks like:

- Cash purchase ROI: 7.6% (with $110,000 total investment)

- Financed purchase ROI: 10.8% (with just $30,000 down payment)

- Financed ROI including equity accumulation: 14.8%

4. Adjust for vacancy and seasonality

Smart investors know market fluctuations matter. Rental markets shift with seasons. Spring and summer bring higher demand while fall and winter show reduced activity.

Your ROI projections should:

- Include vacancy periods (usually 5% of annual rent)

- Account for slower winter rental demand

- Factor in off-season competition

- Adapt pricing to seasonal demand

Successful investors analyze seasonal data to predict ROI trends. This helps maintain occupancy year-round and preserves returns during quiet periods.

Smart investors use the 50% rule – they set aside half the monthly rent for operating expenses before mortgage payments. It also helps to save 1-2% of the purchase price yearly for major repairs like HVAC replacements or roof work.

These four steps help you calculate realistic ROI that accounts for all variables affecting your investment’s performance. This approach helps you spot profitable opportunities and avoid potential losses.

Key Metrics Beyond ROI You Should Know

Smart rental property investors look beyond basic ROI calculations. They use several other metrics to learn about their investment performance. These measurements show different aspects of profitability that ROI might miss.

Gross Yield

Gross yield shows the total annual rental income as a percentage of a property’s market value or purchase price. This simple calculation helps you get a quick picture of a property’s income potential:

Gross Yield = (Gross Annual Rent ÷ Current Market Value) × 100

To cite an instance, a rental home bought for $60,000 that brings in $610 monthly rent ($7,320 annually) gives a gross yield of 12.2%. This number helps investors compare different investment options and figure out fair market rent for properties without rental history.

Notwithstanding that, gross yield doesn’t include operating expenses. Properties with attractive gross yields can still end up with negative cash flow.

Net Operating Income (NOI)

NOI measures how profitable a property is by taking total revenue and subtracting operating expenses. It gives a better picture of actual performance than gross yield:

NOI = Total Income – Operating Expenses

Operating expenses usually include property management fees, maintenance, property taxes, insurance, and utilities. NOI calculations leave out mortgage payments, capital expenditures, income taxes, and depreciation.

This number helps investors see if a property can generate enough revenue to cover mortgage payments and stay profitable. It shows a building’s ability to make money regardless of how it was financed.

Capitalization Rate (Cap Rate)

The cap rate works like the stock market’s return on investment. It shows the relationship between a property’s NOI and current market value:

Cap Rate = (NOI ÷ Property Value) × 100

Most investors see cap rates between 5% and 10% as good investments. Higher rates often mean better potential returns but come with more risk. Stable markets like New York City or San Francisco typically have lower cap rates than riskier ones.

The cap rate also hints at how long it takes to get your money back. A 10% cap rate suggests you’ll recover your investment in about 10 years.

Cash-on-Cash Return

Cash-on-cash return shows your annual pre-tax cash flow compared to the actual cash you put into a property. This number is great when you use financing:

Cash-on-Cash Return = (Annual Pre-Tax Cash Flow ÷ Total Cash Invested) × 100

Here’s an example: You invest $25,000 as a down payment on a property that generates $3,500 annual pre-tax cash flow. Your cash-on-cash return would be 14%.

This metric focuses on cash portions of the investment, unlike ROI or cap rate. It works well for comparing financed real estate investments with other options like dividend-paying stocks. A cash-on-cash return between 8% and 12% usually makes the investment worthwhile.

These four metrics plus ROI give you a complete framework to evaluate rental properties from different financial angles. You can make better-informed decisions about your investments.

Factors That Influence ROI Rental Property Performance

Real estate success goes beyond simple calculations. Investors need to understand several crucial factors that help them make smart decisions to maximize their returns.

Location and local demand

A property’s investment performance heavily depends on its location. Properties located in high-density areas tend to show better NOI growth, earn better risk-adjusted returns, and carry higher systematic risk compared to similar properties in low-density areas. Strong and diverse economies attract a steady flow of tenants, which leads to consistent demand. Rising employment rates and wage growth in an area directly affect rental values and occupancy rates. The property’s value gets a big boost when it’s close to public transportation, shopping centers, schools, and healthcare facilities.

Property type and amenities

Each property type works best in specific locations. Multi-family buildings do well in urban areas, while single-family homes fit better in suburban settings. Properties can reduce utility costs and qualify for tax breaks when they have energy-efficient appliances and better insulation. Yes, it is true that updated kitchens, modern bathrooms, and multi-purpose spaces can bring in higher rents and better tenants. Properties in well-kept neighborhoods with good safety records and quality schools tend to gain more value over time.

Operating expenses and management

The ROI of a rental property takes a direct hit from operating expenses as they affect net operating income. The 50% rule suggests that a property’s operating expenses usually match half its gross annual rental income. The operating expense ratio (OER) should stay between 60-80%, where lower ratios show better operational efficiency. Regular preventative maintenance helps avoid emergency repairs that can get pricey while making the property last longer. The right property management companies can cut down turnover costs through tenant screening, maintenance coordination, and smart pricing.

Regulations and legal restrictions

Federal, state, and local government regulations can either help or hurt rental profits. Rent control and eviction laws often cut into rental income. Zoning laws, property taxes, and building codes can lower property values while making operating costs higher. Smart investors look into all applicable regulations before buying to spot any restrictions that might limit how they can use the property.

Ways to Improve Your Rental Property ROI

Rental property ROI grows with smart management strategies. The right approach can boost your returns without requiring huge investments.

Optimize pricing and reduce vacancies

Empty units mean lost money—vacant months directly affect your yearly ROI. Smart pricing strategies help maximize income while keeping occupancy rates high. Your monthly check of local market conditions should guide price adjustments. Units with great locations, modern kitchens, or special amenities can fetch 10-20% above market rates. Start talking about lease renewals 90 days before they end to minimize turnover. Make property viewings easy by offering flexible times that include evenings and weekends. Quick turnovers are crucial – aim to complete them within 7-10 days since each empty week costs about 1.9% of yearly rent.

Boost guest experience and reviews

Good communication keeps tenants happy and staying longer. Give new tenants detailed information packets about neighborhood perks, school ratings, and transport options. Smart locks and thermostats can justify higher rates. Quick responses to maintenance needs show professionalism and build trust. Customized touches based on tenant priorities, like local tips matched to their interests, make a difference. Note that great guest experiences lead to loyal customers, more referrals, and higher revenue per listing.

Cut unnecessary costs

Regular maintenance reduces emergency repair costs and helps equipment last longer. Get HVAC servicing, gutter cleaning, and system checks done regularly. Work out yearly service deals with trusted vendors to keep maintenance costs predictable. Look into energy-saving upgrades that cut utility bills and might qualify for tax breaks. You can handle minor repairs yourself sometimes—professionals charge hundreds for work that’s often simple to do.

Use automation and smart tools

Property management software handles rent collection, maintenance requests, tenant communication, and financial reports for $50-100 monthly per unit. Online rent payments cut processing costs and improve cash flow through faster payments. Smart home technology attracts tech-savvy renters who pay premium rates and helps your property stand out in busy markets. Analytical insights can help optimize pricing, while predictive systems catch problems before they get pricey.

Conclusion

ROI calculations form the foundations of successful real estate investing. This piece explores how understanding return metrics can shape your investment decisions and portfolio management.

Quality rental properties typically get more and thus encourages more returns between 8-12%, while the best ones can yield 15% or more. Becoming skilled at ROI calculation helps you spot these profitable opportunities before investing your capital.

Looking past simple ROI to metrics like cap rate, NOI, and cash-on-cash return gives you a full picture of your investment’s performance. These complementary measurements show different profit angles that ROI alone might miss.

Your returns depend heavily on location, property type, operating expenses, and local regulations. Smart investors review these factors before buying and keep track of them throughout ownership.

Without doubt, you can boost your property’s performance through strategic pricing, tailored guest experiences, cost-cutting measures, and advanced technology. Small improvements in these areas can boost your bottom line substantially over time.

ROI calculation works best as an ongoing process rather than a one-time review. Markets shift, expenses change, and tenant priorities evolve. Regular assessment of your property’s performance against these metrics leads to data-driven decisions that maximize returns while minimizing risk.

This knowledge gives you the tools to review potential investments with confidence and optimize your existing portfolio’s performance. The gap between average and exceptional returns often comes down to this analytical approach that turns real estate investing from speculation into strategic wealth building.

FAQs

Q1. What is considered a good ROI for a rental property? A good ROI for a rental property typically falls between 8% and 12%. Anything above 15% is considered excellent. Some vacation rental experts suggest aiming for at least a 30% cash-on-cash return, especially when the industry average is around 8%.

Q2. How do you calculate the ROI for a rental property? To calculate ROI, first determine your total investment (purchase price + closing costs + renovations). Then, estimate your annual net income (rental income – operating expenses). Finally, use the formula: ROI = (Annual Net Profit ÷ Total Investment) × 100. Remember to adjust for vacancy and seasonality for a more accurate projection.

Q3. What factors influence rental property ROI? Key factors influencing rental property ROI include location and local demand, property type and amenities, operating expenses and management efficiency, and regulations and legal restrictions. Properties in high-demand areas with strong economies and desirable features tend to perform better.

Q4. What are some important metrics besides ROI for evaluating rental properties? Besides ROI, important metrics for evaluating rental properties include Gross Yield, Net Operating Income (NOI), Capitalization Rate (Cap Rate), and Cash-on-Cash Return. These metrics provide a more comprehensive view of a property’s financial performance and potential.

Q5. How can investors improve their rental property ROI? Investors can improve their rental property ROI by optimizing pricing and reducing vacancies, enhancing guest experience to encourage positive reviews, cutting unnecessary costs through preventative maintenance and energy-efficient upgrades, and utilizing automation and smart tools for more efficient property management.